State Of Florida Mileage Rate 2025 - IRS Announces Standard Mileage Rate Change Effective July 1, 2022, State of florida mileage rate 2025. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official. State Of Florida Mileage Rate 2025. In 2025, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving purposes. See how much you get back with our mileage reimbursement calculator for florida.

IRS Announces Standard Mileage Rate Change Effective July 1, 2022, State of florida mileage rate 2025. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official.

Irs Increases Mileage Rate For Remainder Of 2025 Angel Blondie, Use this table to find the following information for federal employee travel: Meals & incidentals (m&ie) rates and breakdown.

Standard Mileage Rates For 2025 Mady Sophey, Effective from january 1, 2025, the new rate will be 67 cents per mile, a slight increase from the. Use this table to find the following information for federal employee travel:

2022 standard mileage rate / Fort Myers, Naples/ MNMW, See how much you get back with our mileage reimbursement calculator for florida. The per diem rates shown here for lodging and m&ie are the exact rates set by the gsa for the month of july, 2025.

Has just announced that for 2025, a rate of $ 0.67/mile may be used to compensate employees.

* airplane nautical miles (nms) should be converted into statute miles (sms) or regular.

What Is The Government Mileage Rate For 2025 Heda Rachel, 21 cents per mile for medical uses; Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2025.

Illinois State Mileage Rate 2025 Dacy Brandais, Meals & incidentals (m&ie) rates and breakdown. The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2025.

Florida Mileage Rate for 2025 and What It Means for You, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving. The per diem rates shown here for lodging and m&ie are the exact rates set by the gsa for the month of july, 2025.

Effective from january 1, 2025, the new rate will be 67 cents per mile, a slight increase from the.

In 2025, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving purposes. The new rate kicks in beginning jan.

IRS increases mileage rate for remainder of 2022 Local News, An injured worker is entitled to mileage reimbursement in florida workers’ compensation cases for trips to. This document includes the optional 2025 standard mileage rates and details the maximum automobile cost for calculating the allowance under a fixed and variable rate (favr) plan.

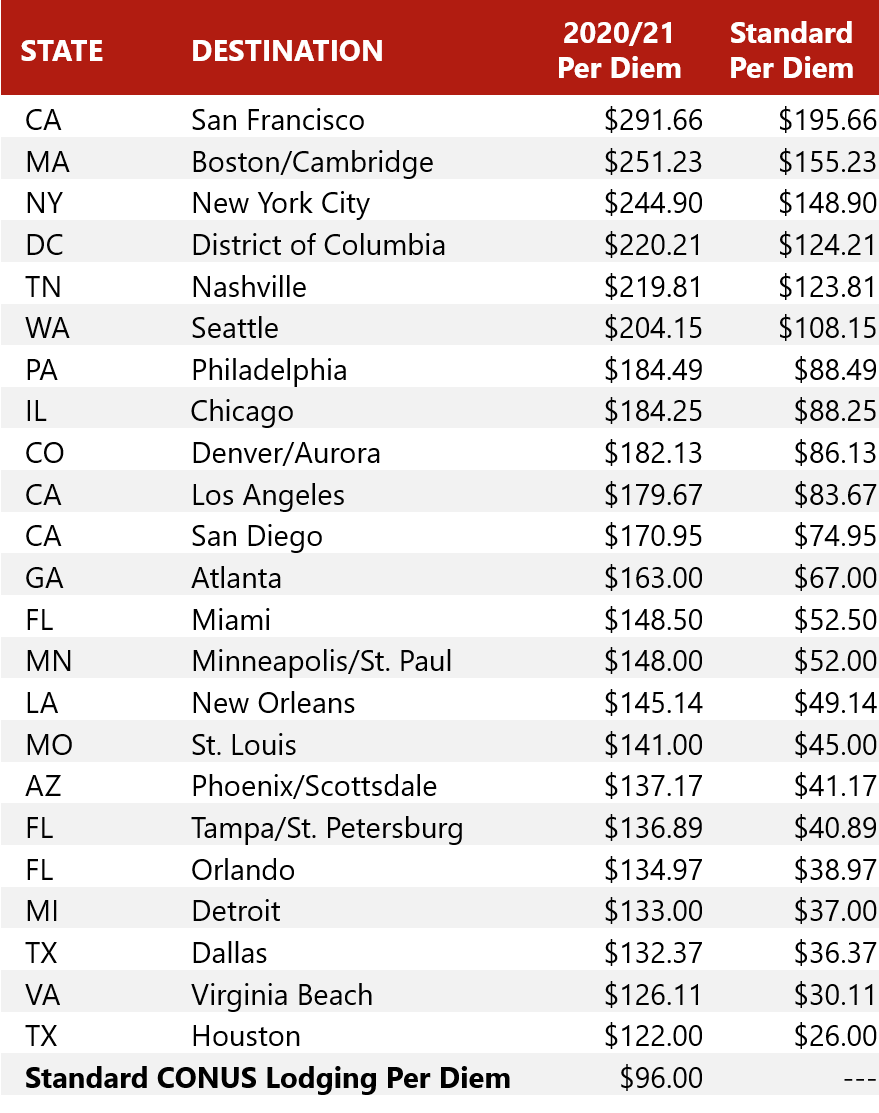

HVS Federal Per Diem Fiscal 2020/21 & Historical Trends, Use this table to find the following information for federal employee travel: Confused about mileage rates per state and what is and isn’t required?

California Minimum Wage 2025 Chart Usa Raven Cathlene, In 2025, the irs set the standard mileage rates at 65.5 cents per mile for business, 14 cents per mile for charity, and 22 cents per mile for medical and moving purposes. 67 cents per mile for business uses;